Get Plant & Equipment Insurance on the Central Coast

Established in 1991

Free Consultations

Locally Owned & Operated

Wide Range of Services

Protect Your Assets

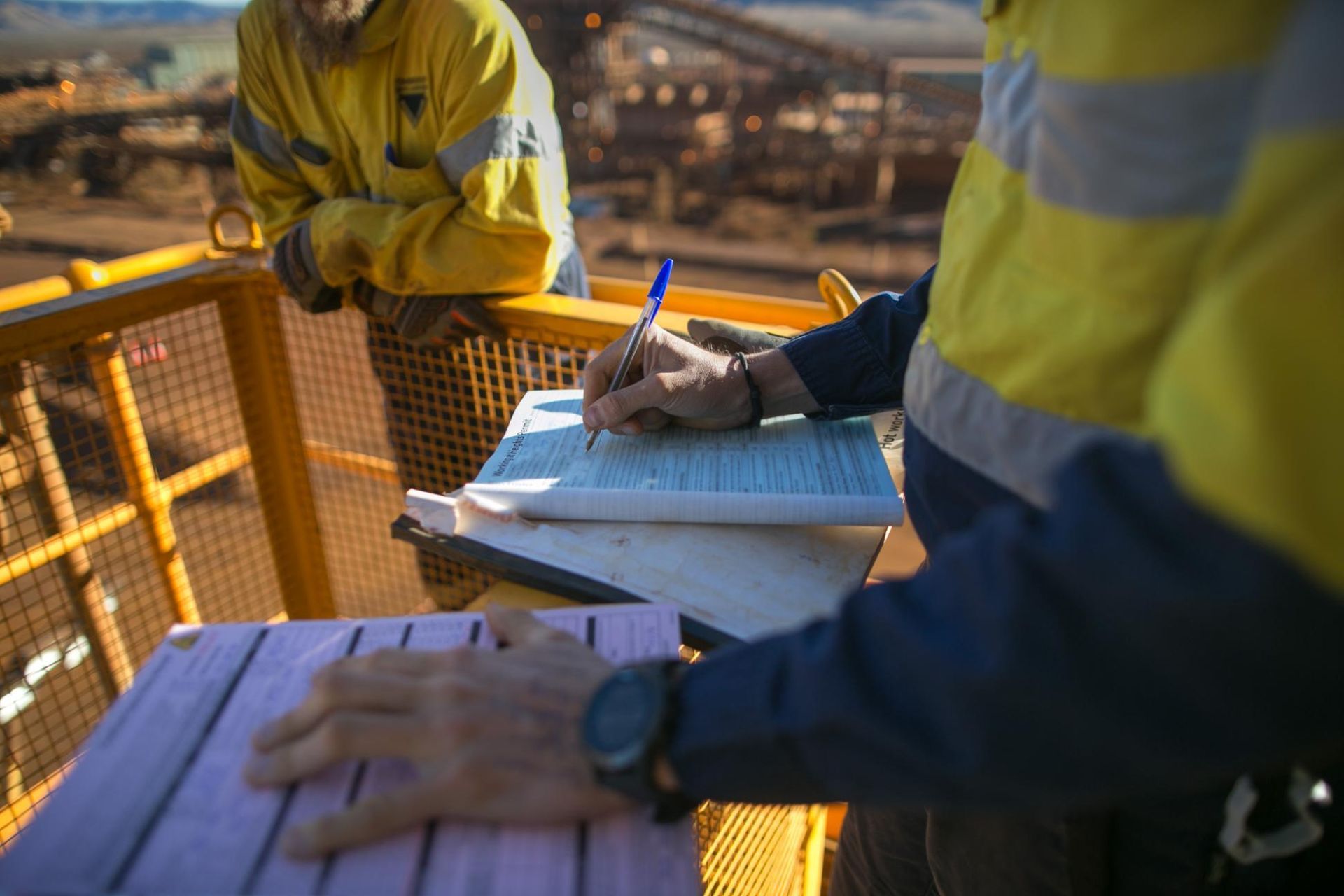

Coast & Country Insurance Consultants offers Plant & Equipment Insurance for contractors and construction companies on the Central Coast and surrounding areas. This essential coverage helps protect machinery, tools, and equipment from risks such as theft, accidental damage, and breakdowns.

Whether you rely on heavy machinery, specialised tools, or essential equipment for your projects, this type of insurance offers financial support to repair or replace items critical to your operations. Plant & Equipment Insurance helps contractors and construction businesses manage potential setbacks and avoid costly delays caused by damaged or stolen equipment.

With over 33 years in business, Coast & Country Insurance Consultants is committed to helping contractors protect their investments and maintain smooth operations. If you’re seeking reliable Plant & Equipment Insurance on the Central Coast, call us on

(02) 4334 3622. We are here to discuss coverage options tailored to the needs of your business. Stay connected with us on Facebook and Instagram for updates and information about our services.

Why Choose This Insurance?

Here’s how this coverage supports contractors and construction businesses:

- Tailored policies address the specific needs of contractors and their equipment.

- Coverage includes protection against theft, accidental damage, and breakdowns.

- Quick claims processes help minimise downtime.

- Policies offer flexibility to adjust coverage as your business evolves.

Plant & Equipment Insurance is vital for contractors who depend on reliable equipment to complete projects efficiently. This coverage helps mitigate the financial impact of unexpected events, allowing businesses to focus on meeting project deadlines without the added stress of unplanned expenses.

Contact Coast & Country Insurance Consultants today on

(02) 4334 3622 to explore coverage options that meet the demands of your operations. Follow us on social media for additional updates and resources.

Insure Your Equipment & Machinery

How much would it cost in lost revenue if a key piece of equipment failed on the job? How about if that very same equipment was stolen—would it be difficult and expensive to replace? When key plant or equipment breaks down, gets pinched or is vandalised; the ensuing downtime and disruption to business can have a significant financial impact. Plant and Equipment Insurance is designed to mitigate this.

At Coast & Country Insurance Consultants we help our business clients find suitable Plant & Equipment Insurance based on their operations, needs and budget. Located in The Entrance, we assist clients throughout the Central Coast, as well as Australia wide. Call (02) 4334 3622 and organise to sit down with one of our experienced brokers & advisors today—you won’t regret it!

Cover for All Types of Industries

When you depend on your plant and equipment to generate revenue, the last thing you need is unintended down time. We can help source insurance for all types of industries including:

- Manufacturing

- Food processing

- Construction

- Excavation & earthmoving

- Logistics

- Equipment hire

- Farming & agriculture

- Fishing & marine

- Brewing & distilling

- Niche industries

If you’re unsure about whether we can find insurance for your specific industry, get in touch and speak with us today—we look forward to speaking with you!

Tailoring Your Insurance

At Coast & Country Insurance Consultants, we can tailor insurance policies and packages to suit your specific industry, business needs and budget. You can obtain cover for:

- Loss of revenue

- Liability whilst in use

- Damage

- Theft

- Machinery breakdowns

- Wet & dry hired equipment

- Lease payments

- Public road driving risk

And much more. We can also source insurances to cover your business for items that don’t fall under Plant & Equipment policies, such as Contract Works, Public Liability, Professional Indemnity and Heavy Vehicle Insurance.

Frequently Asked Questions

What is Contractors, Plant & Equipment Insurance?

Contractors, Plant & Equipment Insurance provides financial protection for machinery, tools, and equipment used in construction or contracting work. It covers risks such as theft, accidental damage, or equipment breakdowns, helping contractors manage the costs of repairing or replacing essential items. This insurance is especially valuable for businesses that rely on heavy machinery or specialised tools, as it reduces the financial strain caused by unexpected events. The coverage is designed to minimise disruptions, allowing contractors to focus on completing projects without delays caused by financial or operational setbacks due to equipment-related issues.

Who should consider Contractors, Plant & Equipment Insurance?

This insurance is important for contractors, builders, and construction companies that use tools, equipment, or machinery in their projects. Businesses involved in excavation, earthmoving, or construction often face higher risks due to the reliance on specialised equipment. Freelancers or small contractors who use expensive tools also benefit from this coverage, as it helps mitigate the impact of theft or damage. Additionally, larger construction firms operating across multiple sites often require this insurance to protect their assets and maintain workflow. If your business depends on tools or machinery to complete projects, this insurance is a practical safeguard.

What does Contractors, Plant & Equipment Insurance typically cover?

Contractors, Plant & Equipment Insurance typically covers the costs of repairing or replacing machinery, tools, and equipment due to theft, accidental damage, or breakdowns. It may also include coverage for equipment hired by the contractor, providing flexibility for businesses that rent machinery for specific projects. Some policies extend to cover damage during transit or while on-site, helping protect assets across multiple locations. Coverage can be tailored to suit different business needs, addressing risks associated with specific industries or project types. By addressing these potential issues, this insurance helps businesses maintain productivity and manage unforeseen expenses effectively.

Am I covered under Plant & Equipment Insurance if my on-site machinery get stolen overnight?

Each Plant & Equipment policy will have its own inclusions stipulated—this can vary from policy to policy. However, typically if your machinery—such as an excavator—has been properly secured overnight then you will be covered if it’s stolen or damaged. Talk to our brokers & advisors today to find the right insurance for you with the inclusions you deem important to your business’ operational demands.

My business operates in a very niche industry; will I be able to find an insurer?

Each insurance company has its own risk appetite and exposure profile. This means that not all insurers provide insurance for every industry. Particularly with the major insurers, you may find that your business falls through the gaps. As brokers, we can assess offerings from lots of different insurers, including those that insure niche industries and non-typical businesses. Insurance brokers have the flexibility to shop around to try and find the right policy that covers your unique requirements.

What does ‘agreed value’ mean?

‘Agreed value’ is a common term used by insurers. Under many polices, including Plant & Equipment Insurance, when your insured equipment is stolen or deemed a ‘write-off’, the insurer will agree to pay out based on its ‘market value’. An alternative to this is to agree on a pay-out value for your equipment upfront when taking out the policy. Doing so will typically affect the cost of your premiums.